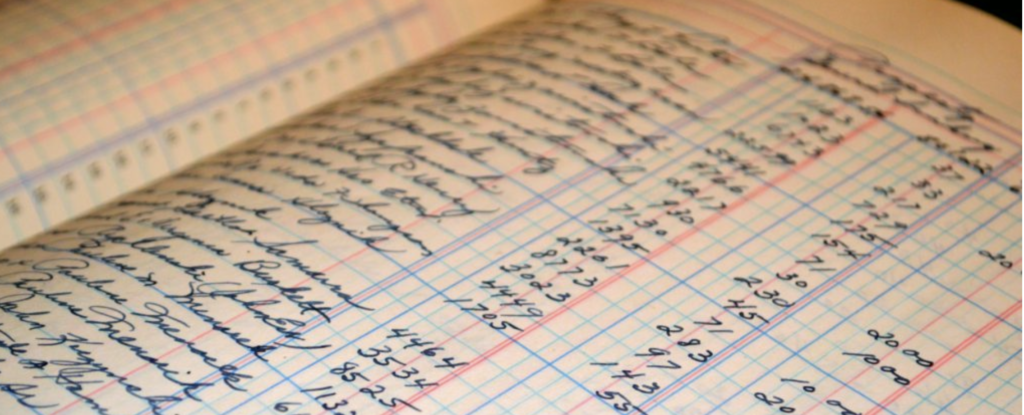

How long should you keep your business records for? And why does it matter?

As business owners, it’s often confusing to know what type of records you need to keep and for how long.

In today’s ‘Ask CHN’ blog, we’ll explain the general timeframes about how to keep which records from when your business tax return was lodged.

These are:

- 5 years for most businesses

- 7 years for companies (under the 2001 Corporations Act requirements)

- 10 years for self-managed super funds

How to keep ATO-ready records

Keeping well-prepared records will help your accountant provide a better service to you while also helping to minimise cost (as you aren’t paying us to sort through & organise records.

Having excellent and up-to-date records also mean we can assist with quicker and less costly resolution of ATO enquiries, reduce the risk of tax audits and adjustments and you avoid exposure to penalties.

You’ll also feel more in control of your income and expenses too.

Make technology work for you

Applications like ReceiptBank and Hubdoc enable simple and efficient record keeping for all business owners.

ReceiptBank is an automated data-entry and book-keeping tool that allows you to spend more time with your clients and keeps you updated in real-time.

Hubdoc automatically imports all your financial documents and export them into data you can use.

If the technology is there, then why not use it?